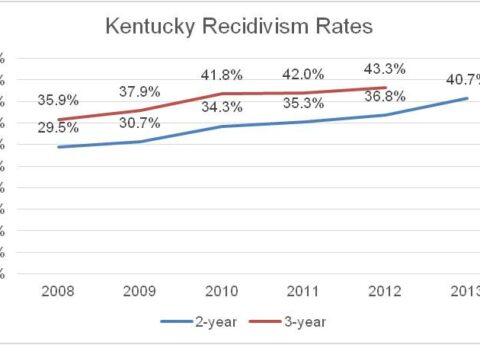

What is Recidivism and What Can Be Done to Reduce It?

Policy discussions around the need for criminal justice reform like those happening in our state right now often feature the...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap