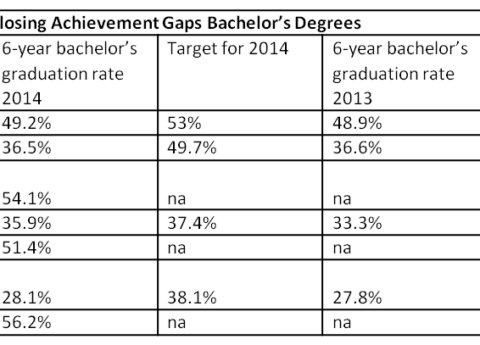

New State Report Shows Little to No Progress on Achievement Gaps

The Council on Postsecondary Education’s latest accountability report, which was released yesterday, shows Kentucky has continued to make little to...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap