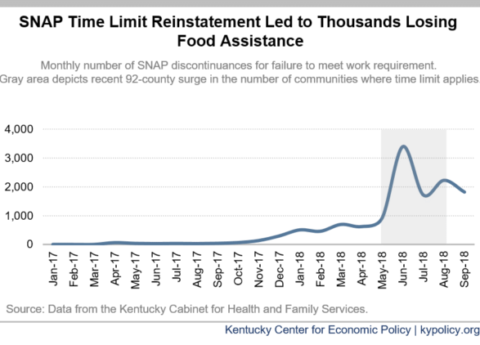

Reinstated SNAP Time Limit Has Led to Thousands Without Food Assistance

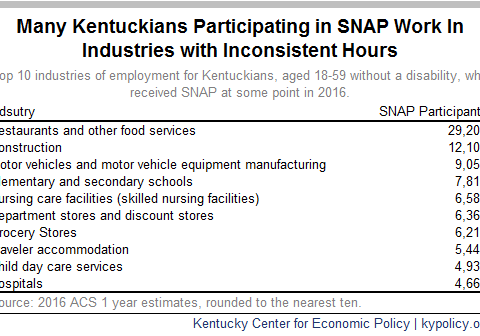

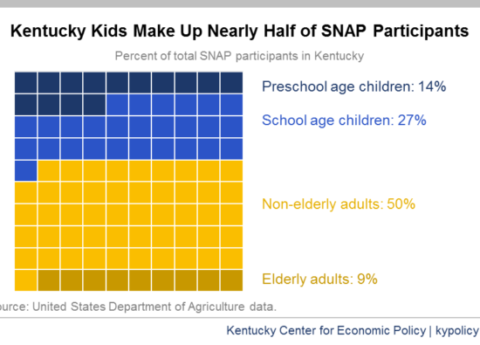

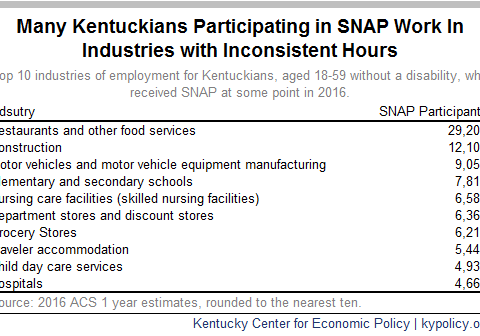

Since May, 10,097 Kentucky adults have lost food assistance as a result of new barriers to Supplemental Nutrition Assistance Program...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap