Senate Pension Bill Also Breaks Inviolable Contract

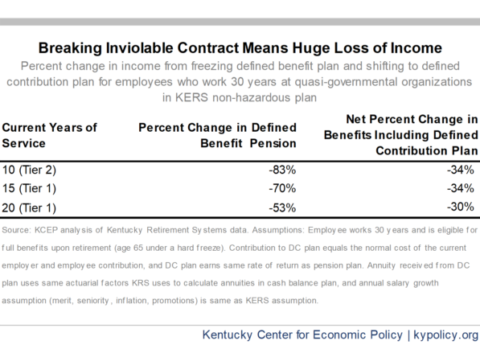

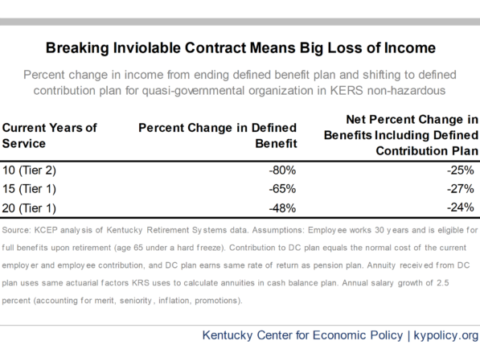

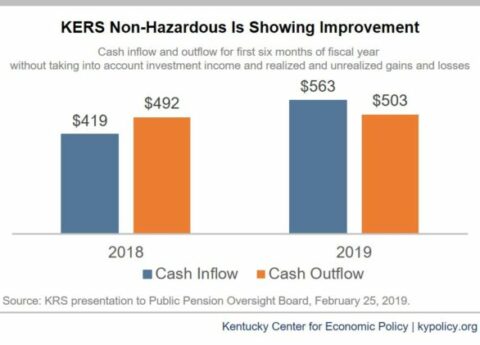

When the governor vetoed House Bill 358, the legislation affecting pension costs for quasi-governmental organizations like community mental health centers...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap